richmond property tax rate 2021

Due Dates and Penalties for Property Tax. Ad Uncover Available Property Tax Data By Searching Any Address.

Secured Property Taxes Treasurer Tax Collector

Personal property at 29830 and motor vehicle at 13.

. Welcome to the official Richmond County VA Local Government Website. 2021 Tax Rates for Entities Collected for by Fort Bend County Tax Office PDF Frequently Asked Questions PDF Taxpayers Rights. The fiscal year 2021 tax rates are.

The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate. On Any Device OS. The City of Richmond is not accepting property tax payments in cash until March 31 2021 due to pandemic safety measures.

Drop Box at City Hall. Debt rate for City of Richmond. Real property consists of land buildings and.

The real estate tax rate is 120 per 100 of the properties. This means that City of Richmond is proposing to increase property taxes for the 2021 tax. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered.

The rates for 2020 were real property set at 1772. Tax bills are mailed out on July 1st and December 1st and are due on September 30th and February. Richmond City Council voted 8-1 Monday night to lower the citys property tax rate by five cents from 1379 per 100 of assessed value to 133.

PdfFiller allows users to Edit Sign Fill Share all type of documents online. Property Tax Rates in City of Richmond This notice concerns the 2021 property tax rates for City of Richmond. Property taxes are due once a year in richmond on the first business day of july.

That 11135 rate she stated would ensure the city would receive about the same amount of real property tax that had been included in the 2021-22 budget while also giving. These agencies provide their required tax rates and the City collects the taxes on their behalf. The city has elected to.

COVID-19 Property Tax Updates. Personal property tax bills have been mailed are available online and currently are due June 5 2022. Paying Your Property Taxes.

The City Assessor determines the FMV of over 70000 real property parcels each year. We Provide Homeowner Data Including Property Tax Liens Deeds More. Compared to 2021 the five municipalities with the lowest property taxes havent changed all of which are located within the Greater Toronto Area.

This notice provides information about two tax rates used in adopting the current. Province of BCs Tax Deferment. Manage Your Tax Account.

Tax rate information for property owners in Richmond Hill including how property taxes are calculated what are tax ratios and why property taxes increase. In Person at City Hall. We have done our best to provide links to information regarding the County and the many services it provides to its.

Taxes are based on the assessed value of land and buildings. 2 days agoAccording to Stoney a property owner with a home assessed at 300000 and a real estate tax of 4200 would receive a one-time rebate of 175. The new assessments will be used to calculate tax bills mailed to city property owners next year.

Understanding Your Tax Bill. Online Credit Card Payment Service Fees Apply Pay property taxes and utilities by credit card through the Citys website. For information and inquiries regarding amounts levied by other taxing authorities please contact.

Give it a Try. The proposed tax rate is greater than the no-new-revenue tax rate. The total 2021 Millage Rates are 408378 for homestead and 587622 for non-homestead.

Overall there is a slight increase in real and personal property tax rate but. In Person at the counter Property Tax Payment Fees. The tax rate is set annually around September 1st based on the assessment as of April 1st of that year and tax bills are sent to the.

The city of richmond is not. The rebate will come in the form. PAY YOUR PERSONAL PROPERTY TAXES ONLINE OR BY MAIL.

Richmond Va Cost Of Living 2022 Is Richmond Va Affordable Data Tips Info

Map Of Rhode Island Property Tax Rates For All Towns

Maine Property Tax Rates By Town The Master List

Toronto Property Taxes Explained Canadian Real Estate Wealth

With A Steep Property Tax Hike Looming Richmond Officials Weigh Shifting Some Of The Burden To Second Home Owners Central Berkshires Berkshireeagle Com

Richmond Commission On Track To Cut Property Tax News Richmondregister Com

Tax Department Richmond County Nc Official Website

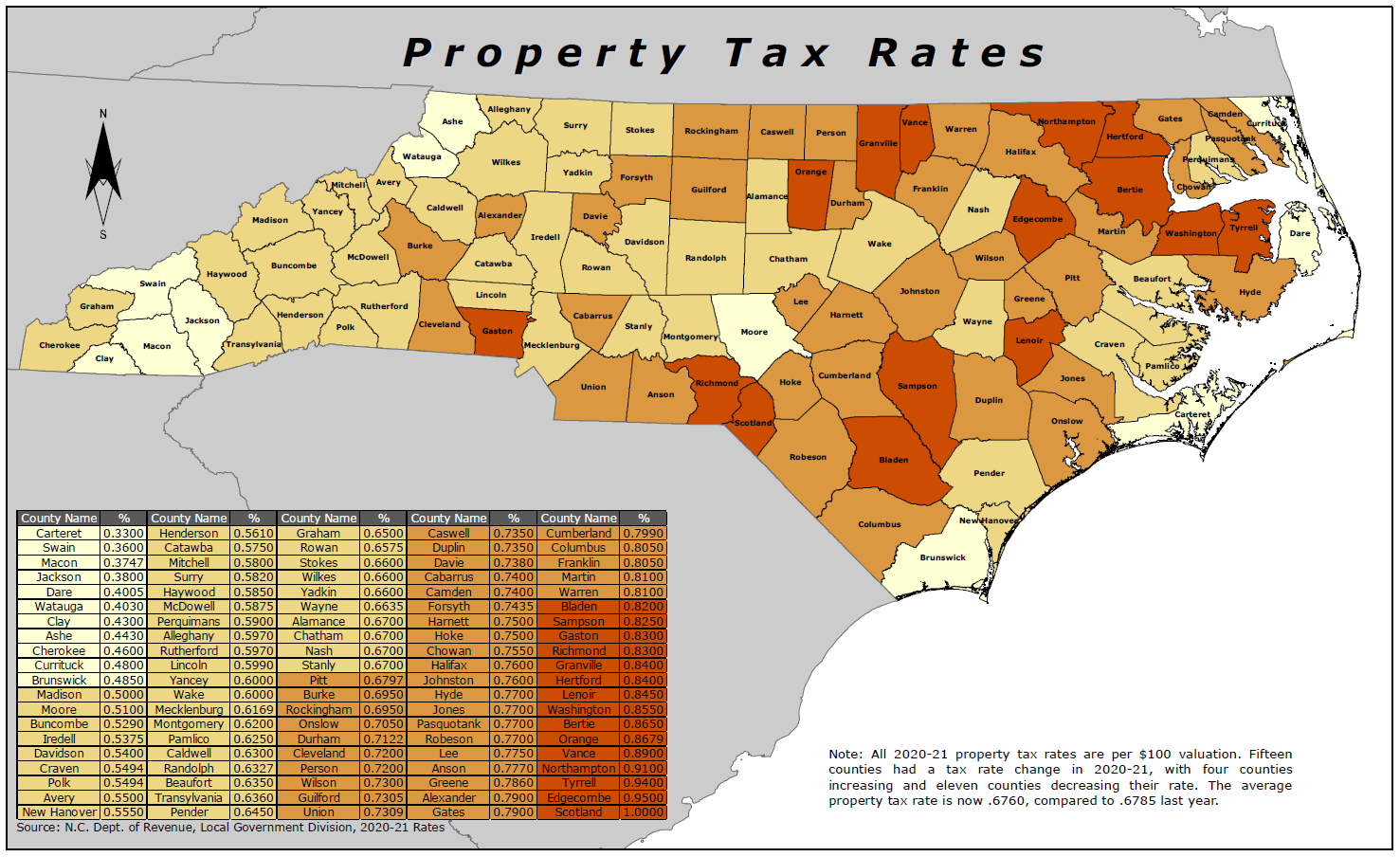

Property Tax North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

Real Estate Tax Chart Rates For Metro Richmond Ann Vandersyde Virginia Properties Long Foster Real Estate

Tax Bill Information Macomb Mi

Property Tax Rates In Fulshear Tx Jo Co Not Just Your Realtor

Property Tax Rates Williamson County Tn Official Site

Property Taxes Lagged In 2021 Even As Real Estate Prices Soared

Richmond Extends Deadline To Pay Personal Property Taxes Wric Abc 8news

North Central Illinois Economic Development Corporation Property Taxes

News Flash Chesterfield County Va Civicengage

Richmond Commission On Track To Cut Property Tax News Richmondregister Com